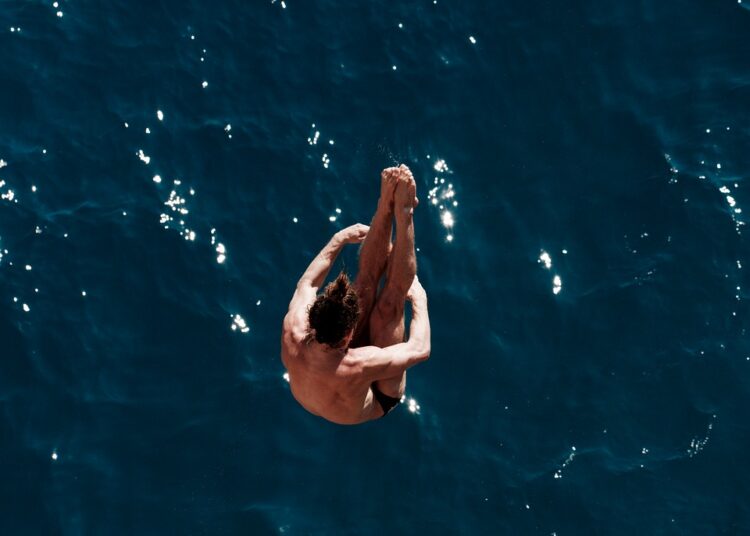

Hey there! If you’re a recent university graduate, aged 22-25, you might be feeling a little overwhelmed with your first salary. Congratulations on that big milestone! With newfound financial independence, you probably want to make smart money moves, starting with saving. A high-yield savings account sounds like a fantastic option, right? But, before you dive in, it’s essential to know: what are the risks of a high-yield savings account?

In this article, we’ll break down the five critical factors you need to consider. By understanding these risks, you can make informed decisions that will help reduce any financial anxiety and set the stage for healthy money habits. Let’s get started!

1. Interest Rate Changes

What It Means: When you open a high-yield savings account, you’re usually attracted to the higher interest rates compared to regular savings accounts. However, these rates can change.

Why This Matters:

- Variable Rates: Many high-yield accounts offer variable interest rates. This means that while you might be enjoying a great rate now, there’s a chance it could drop later—often fluctuating based on economic conditions.

Example: Think of it like the temperature outside; some days might be warm and pleasant, while others can get chilly. Similarly, your interest rate can go up or down.

2. Fees that Eat Into Your Earnings

What It Means: Some providers may charge monthly maintenance fees or transaction fees. Even minor fees can add up, diminishing your savings.

Why This Matters:

- Low Balance Fees: If your account balance falls below a certain amount, you may be charged a fee. This can happen more easily than you think, especially if you’re just starting to save.

Tip: Always check the fine print for any hidden fees before opening an account. It’s like reading the instructions before assembling furniture—important!

3. Limited Access to Your Funds

What It Means: High-yield savings accounts often come with withdrawal limits or restrictions. For instance, you may be only allowed to make a certain number of withdrawals each month.

Why This Matters:

- Emergency Situations: If you find yourself in a situation where you need quick access to cash (like an unexpected car repair), you might face penalties or delays if you exceed the allowed withdrawals.

Tip: Consider keeping an emergency fund in a regular savings account or checking account that offers unlimited access, just in case.

4. Inflation Risk

What It Means: Inflation is when prices for goods and services increase over time. If your interest rate doesn’t keep up with inflation, the actual value of your savings could decrease.

Why This Matters:

- Real Value Loss: For example, if your account earns 3% interest, but inflation is 4%, you’re actually losing money in terms of purchasing power. Your future self might find it harder to afford the same things.

Analogy: Think of inflation like a sneaky thief that quietly takes away some of your money’s value without you noticing right away. Keeping an eye on it is vital.

5. Limited Investment Growth

What It Means: While high-yield savings accounts are a safe place for your money, they usually don’t offer the same growth potential as investments like stocks or mutual funds.

Why This Matters:

- Opportunity Cost: By keeping all your savings in a high-yield account, you may miss out on potentially higher returns from investments. This could hinder your financial goals in the long run.

Tip: Consider diversifying your financial portfolio as you grow more comfortable with savings. It’s about finding the right balance!

Conclusion & Call to Action

In summary, a high-yield savings account can be a great way to earn interest on your money, but it comes with risks like interest rate changes, fees, limited access, inflation concerns, and lower growth potential. Remember, knowledge is power, and being aware of these risks can help you make informed financial decisions.

Words of Encouragement: It might feel a little daunting to navigate money matters for the first time—just take it one step at a time.

Small Action Step: Take a moment right now to compare high-yield savings accounts from different banks. Look for things like interest rates, fees, and withdrawal limits. You’re off to a great start on your journey to smart saving!

Happy saving! 🌟