Introduction

You’re not alone if managing your money feels like trying to solve a Rubik’s Cube blindfolded. It’s complicated, daunting, and frankly, overwhelming. But here’s the good news: financial literacy doesn’t have to be intimidating! Understanding basic finance can transform your life, giving you the confidence to plan for the future, save for that dream vacation, or even navigate your student loans.

In this article, we’ll walk you through some foundational financial literacy resources that can simplify budgeting, saving, and financial planning. By the end, you’ll have actionable strategies to take your first confident steps toward getting your finances in order. Let’s dive in!

Section 1: Understanding Financial Literacy

Financial literacy is more than just knowing how to balance a checkbook; it’s about understanding how money works. This encompasses everything from budgeting and saving to understanding credit and investing.

-

Why It Matters: Without basic financial literacy, you might struggle to make informed decisions about your money. This can lead to debt, insufficient savings, and financial stress. Seeing money management as a power rather than a chore can change everything!

-

Get Started: Check out resources like Khan Academy’s Personal Finance Course or the National Endowment for Financial Education. These platforms offer free courses tailored to various aspects of personal finance, breaking down complex concepts into digestible lessons.

Section 2: Budgeting Basics

A budget is your game plan for managing your money. It helps you control your spending and allocate funds toward your goals.

-

The 50/30/20 Rule: This simple budgeting method suggests you allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

-

Tools to Help: Consider using budgeting apps like Mint or You Need a Budget (YNAB). These apps allow you to track income and expenses, helping you stick to your budget in real-time.

Section 3: Saving Strategies

Saving money is crucial, whether for an emergency fund or long-term goals like buying a home or retirement.

-

Set Clear Goals: Make your savings objectives specific. For example, instead of just saving “for a vacation,” determine how much you’ll need and by when.

-

High-Interest Savings Accounts: Look into options like Ally Bank or Marcus by Goldman Sachs, which often provide better interest rates than traditional banks.

-

Automate Your Savings: Set up automatic transfers from your checking to your savings account. When you treat savings as a non-negotiable expense, it becomes easier to prioritize.

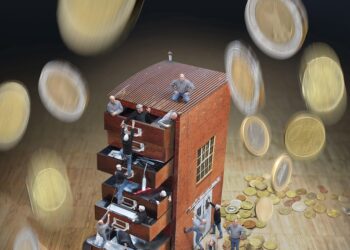

Section 4: Understanding Debt

If you’re like most young adults, managing student loans or credit card debt can feel overwhelming. Knowing how to handle debt is a key aspect of financial literacy.

-

Know the Types of Debt: Distinguish between good debt (like a mortgage) and bad debt (high-interest credit cards). Focus on paying off high-interest debts first.

-

Debt Repayment Resources: Tools like the Debt Snowball Method can help. This approach focuses on paying off the smallest debts first for quick wins, building momentum as you pay down larger amounts.

Section 5: Financial Planning for the Future

Looking ahead is crucial for building long-term wealth. Understanding retirement accounts, investments, and insurance can set you up for success.

-

401(k) and IRA: If your employer offers a 401(k) plan, take advantage of any matching contributions. Also, consider opening a Roth IRA for tax-free growth of your retirement savings.

-

Investment Resources: Websites like Investopedia and apps like Robinhood can help you get started with investing. Start small, learn as you go, and build your investment knowledge over time.

Conclusion + Call to Action

To recap, here are the key takeaways for your financial journey:

- Financial literacy is essential for informed money management.

- Budgeting gives you control over your spending.

- Saving strategically helps you achieve your financial goals.

- Understanding and managing debt is critical for long-term health.

- Planning for the future sets the stage for financial freedom.

Now, here’s your actionable step: Download a budgeting template from websites like Tiller or use an app to start tracking your expenses today. Don’t wait—begin to take control of your financial future starting now!

Your journey to financial literacy begins today. Embrace the process, celebrate small victories, and watch how your confidence in managing money grows!