Hey there! If you’re a recent graduate, aged 22-25, and have just landed your first job, congrats! 🎉 It’s a big milestone, but I totally understand how it can feel overwhelming: suddenly you’re earning money and thinking about how to manage it wisely. You might find yourself wondering where all those hard-earned dollars go by the end of the month.

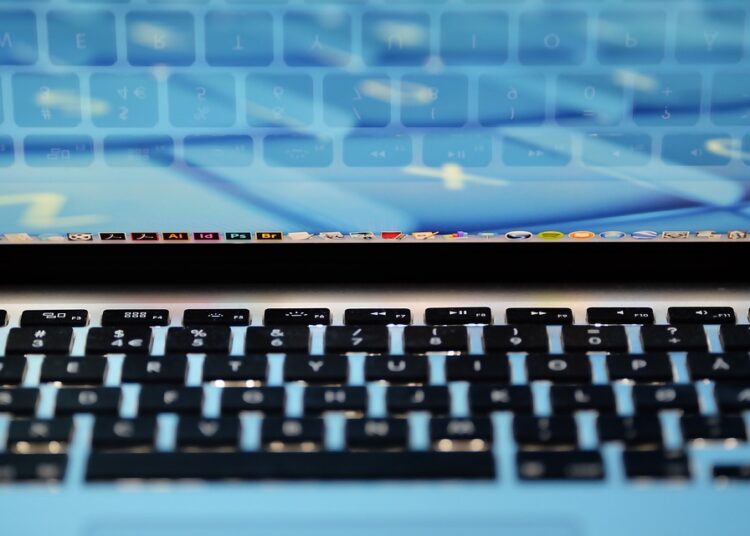

But fear not! This guide is here to help you choose the best budgeting software for Mac. By the end, you’ll have a clearer picture of your finances and build healthy financial habits, all while reducing any anxiety you might feel about managing your money. Let’s dive in!

What to Look for in Budgeting Software

When searching for the best budgeting software for Mac, consider a few key characteristics that will make your financial journey smoother:

1. User-Friendliness

First up, you want software that feels intuitive and easy to navigate. A well-designed interface makes it simpler for you to track your budget without getting lost in complicated menus.

- Look for:

- Simple dashboards

- Easy data entry

- Clear tutorials or onboarding processes

2. Features That Fit Your Needs

Different people have different budgeting styles! Some prefer tracking expenses manually, while others love automation. Think about what features might benefit you:

- Expense Tracking: Ideal for monitoring daily spending.

- Goal Setting: Helps you save for something special, like a trip.

- Reporting: Visual graphs can show you where your money is going.

3. Compatibility with Your Banking Needs

One of the most significant benefits of budgeting software is its ability to sync with your bank accounts. This makes tracking income and spending so much easier! Make sure any software you consider can safely connect to your financial institutions.

- Tip: Look for features like bank syncing or direct input of expenses.

4. Pricing and Value

You’re just starting your financial journey, so finding cost-effective options is essential. Many budgeting tools have free versions or trial periods so you can test them out.

- Check for:

- Subscription fees

- Free trials

- Any hidden costs or transactions fees

5. Customer Support and Community

Sometimes, you just need a little guidance! Knowing that there’s support available when you hit a snag can be a huge relief.

- Consider: Look for options that offer robust customer support—whether through a help desk, live chat, or community forums.

6. Personalization Options

Finally, you want software that can grow with you. Think about whether you’ll still be using this tool a year from now. Features that allow you to adapt as your financial situation changes can make a huge impact.

- Features to seek out:

- Custom categories for expenses

- Flexible budgeting tools for future adjustments

Conclusion & Call to Action

To sum it all up, when searching for the best budgeting software for Mac, prioritize user-friendliness, relevant features, banking compatibility, pricing, customer support, and personalization.

Starting your financial journey on the right foot is crucial, and budgeting software can help you build those healthy habits without the stress.

🎯 Small Action Step: Take a moment right now to jot down your budgeting needs. What features resonate with you most? This will guide your search and reduce the feeling of overwhelm as you take control of your finances.

You’ve got this! Remember, it’s all about small steps leading towards a bright financial future. Happy budgeting!