Hey there! If you’re a recent university graduate who’s just received your first salary, congratulations! 🎉 But, along with that exciting paycheck, you might also feel a wave of financial anxiety crashing over you. It’s completely natural to feel overwhelmed as you step into the world of budgeting, saving, and investing.

In this guide, we’ll break down what financial anxiety is and give you a practical roadmap to conquer it. By the end, you’ll have a clearer understanding of how to take control of your finances, allowing you to feel more confident and at ease with your money.

What is Financial Anxiety?

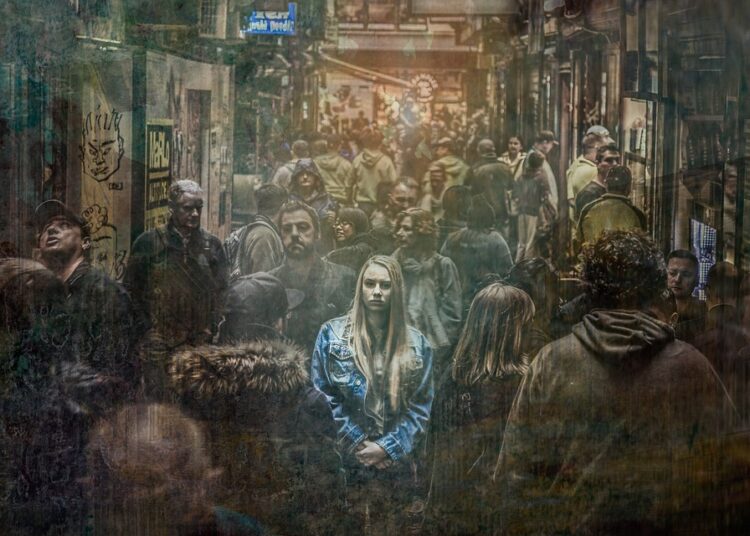

Financial anxiety refers to the worry, stress, or panic that comes from thinking about money—whether it’s bills, student loans, or future savings. Imagine it as a rain cloud that looms over you, making it hard to focus on everything else. The good news? You can clear that cloud with some simple, practical steps.

Step-by-Step Guide to Conquering Financial Anxiety

Section 1: Know Your Financial Landscape

Understanding your current financial situation is the first key step.

- List Your Income: Write down all sources of income, including your salary and any side gigs.

- Track Your Expenses: For a month, keep note of every dollar you spend—yes, even that coffee! It’ll help you see where your money is going.

- Get a Clear Picture: Add it all up. Knowing exactly where you stand financially will help demystify your money worries.

Tip: Use apps or spreadsheets to make tracking simple!

Section 2: Set Clear, Achievable Goals

Now that you know what you’re working with, it’s time to set some goals.

- Short-Term Goals (1-6 months): These could include building an emergency fund of $500 or paying off a small debt.

- Medium-Term Goals (1-3 years): Think about saving for a vacation or a reliable car.

- Long-Term Goals (3+ years): This could involve saving for a house deposit or investing for retirement.

Remember: Make your goals “SMART”—Specific, Measurable, Achievable, Relevant, Time-bound.

Section 3: Budgeting Basics

Creating a budget is like creating a financial map that guides you on where to go.

-

Choose a Budgeting Method:

- 50/30/20 Rule: Allocate 50% for needs, 30% for wants, and 20% for savings or debt repayment.

- Zero-Based Budget: Every dollar should have a purpose, down to zero, so you know exactly where your money is going.

-

Stick to Your Budget:

- Use budgeting apps or tools to help you stay on track.

- Review and adjust monthly—life changes, and so should your budget!

Section 4: Build a Safety Net

An emergency fund is a great way to reduce anxiety about unexpected expenses.

- Aim for 3-6 months’ worth of living expenses.

- Start small if you need to—set aside $10 each week to build this fund.

- Having a buffer will give you peace of mind and significantly lessen stress when surprises arise.

Section 5: Educate Yourself About Finances

Knowledge is power! The more you understand, the less anxious you’ll feel.

- Read Books and Blogs: Consider reading “The Total Money Makeover” by Dave Ramsey or personal finance blogs.

- Take Online Courses: Websites like Coursera or Skillshare have beginner courses on budgeting and investing.

- Join a Community: Connect with friends or online communities interested in financial literacy to share tips and experiences.

Conclusion & Call to Action

In summary, conquering financial anxiety is about understanding your finances, setting achievable goals, budgeting wisely, building a safety net, and educating yourself. It may seem daunting at first, but taking these steps will help clear that rain cloud and put you in control.

Remember: You’re not alone in feeling this way—it’s a journey many have traveled.

Your Action Step

Take one small action right now: Write down your total monthly income and expenditures. This step will kickstart your journey toward financial clarity and peace of mind!

You got this! 🌟 Begin your journey today, and watch your financial anxiety start to fade away!