Hey there! If you’re reading this, chances are you’re feeling a bit lost after a job loss. I want you to know you’re not alone; many feel overwhelmed and uncertain about the future when it comes to navigating life after a job. Don’t worry; we’re here to help you through this tough time!

In this article, you’ll find seven actionable strategies to help you not only cope with your current situation but also rebuild your career with confidence. Whether you’ve just graduated or are in the midst of your career, these tips will guide you toward a brighter future. Let’s dive in!

1. Allow Yourself to Grieve

Job loss can be emotionally challenging. Take a moment to acknowledge your feelings—it’s normal to feel sad, anxious, or even angry.

- Write it down: Journaling can help you process your emotions.

- Talk about it: Share your thoughts with friends or family who can lend a listening ear.

It’s okay to feel low; the key is to let those feelings pass, rather than becoming overwhelmed by them.

2. Assess Your Financial Situation

Understanding your financial resources is crucial. Here’s how to get started:

- List your expenses: Write down your monthly costs (like rent, utilities, and groceries).

- Review your savings: Consider how long you can support yourself without income.

- Look into benefits: If eligible, explore unemployment benefits; they can assist you financially in the short term.

By assessing your financials, you’ll reduce anxiety and set a firm foundation for what’s next.

3. Update Your Resume and LinkedIn

A polished resume and LinkedIn profile can significantly improve your chances of landing a new job. Here’s what to do:

- Highlight achievements: Instead of listing duties, focus on your accomplishments and skills.

- Add keywords: Use industry-related keywords for better visibility.

- Include a professional photo: A good professional photo can make a strong first impression.

Think of your resume and LinkedIn as the storefront for your personal brand; make it attractive to potential employers!

4. Network Like Crazy

Networking can feel daunting, but it’s one of the most effective ways to find new opportunities. Here’s how to get started:

- Reach out to old colleagues: Let them know you’re looking and ask for guidance or leads.

- Join professional groups: Check out local or online organizations related to your field.

- Attend events: Participate in industry conferences or webinars.

Networking is about building relationships, not just job hunting. Think of it as making new friends in your industry.

5. Up-Skill or Re-Skill

Consider this time an opportunity for personal growth. Pick up new skills or refine existing ones:

- Online courses: Websites like Coursera or Udemy offer a variety of courses.

- Certifications: Look for certifications relevant to your field that can make your resume stand out.

Investing in yourself now can pay you back tenfold in future job prospects!

6. Explore Alternative Career Paths

Sometimes, job loss opens the door to new possibilities. Ask yourself:

- What have I always wanted to try?

- Are there industries I never considered?

Don’t be afraid to explore! This might be the perfect time to pursue something you’re passionate about, even if it’s outside your traditional career path.

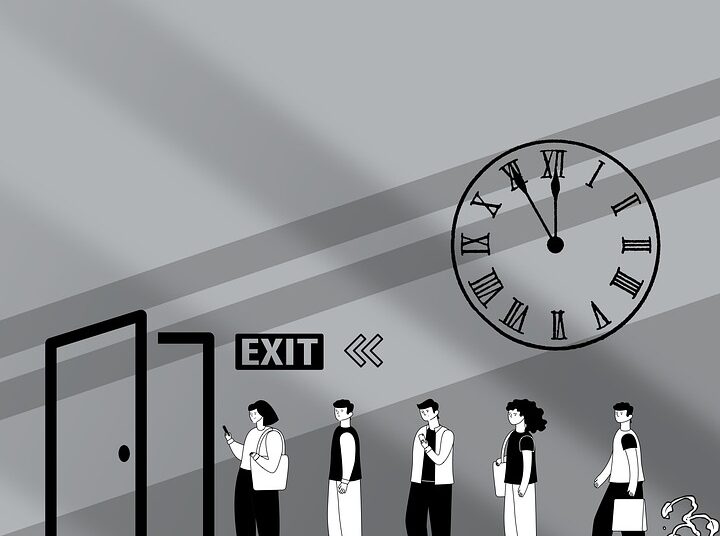

7. Create a Daily Routine

Having a set daily schedule can help restore a sense of normalcy:

- Set a wake-up time: Stick to a routine, just like when you had a job.

- Allocate time for job searching: Make time each day, so you stay productive.

- Include leisure activities: Balance work with hobbies or exercise.

Having structure can ease anxiety and help you stay focused on your goals.

Conclusion & Call to Action

Navigating a job loss can feel daunting, but remember—each step you take is a step toward a new opportunity. Here are the key takeaways:

- Allow yourself to feel; it’s okay to grieve.

- Assess your finances to reduce anxiety.

- Update your professional presence to attract new opportunities.

- Network and build relationships.

- Invest in yourself by learning new skills.

- Explore new paths to find what truly excites you.

- Create a daily routine to keep you focused.

Take a deep breath and believe in your ability to turn this situation around.

Here’s your first actionable step: Spend 15 minutes today updating your resume or LinkedIn profile. Get started; you’ve got this!

You’re not just rebuilding your career; you’re crafting a new chapter in your professional story. Here’s to new beginnings! 🌟