Hey there! If you’re a recent graduate just stepping into the world of work and finances, I know how overwhelming it can feel right now. You’ve got your first salary in your pocket, but if you’re considering taking out a loan—whether it’s for a car, a home, or something else entirely—you might be wondering, “What documents are needed for a loan?”

Don’t worry; you’re not alone. Many new professionals face the same questions. In this article, I’ll break down the seven essential documents you’ll need when applying for a loan. With this knowledge, you’ll feel more confident in the process and ready to manage your financial future. Let’s dive in!

Section 1: Identification Documents

The first step to getting that loan is proving who you are. You’ll typically need:

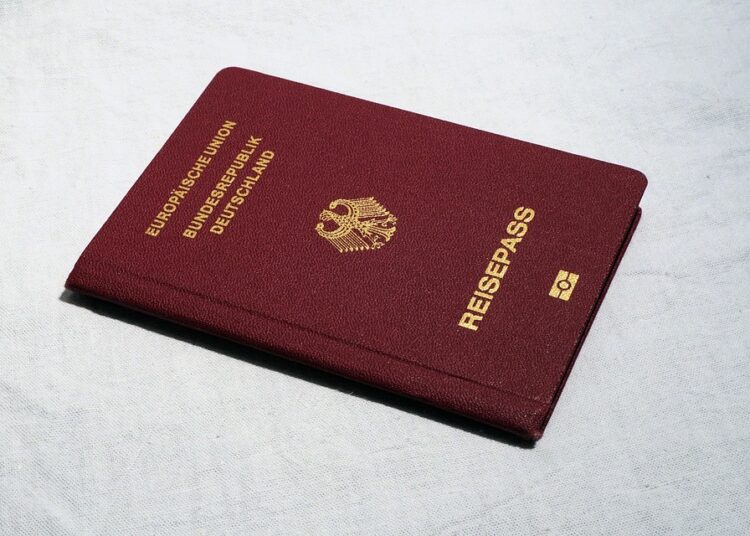

- Government-issued ID: This could be your driver’s license or passport. Think of it as your financial “name tag” that shows lenders you are who you say you are.

- Social Security Number (or equivalent): For those in the U.S., this is crucial. It helps lenders check your credit history, kind of like a report card for your financial behavior.

Having these documents ready shows you’re serious and organized!

Section 2: Proof of Income

Next up is showing lenders how much money you make. This is crucial because it helps them determine how much they can safely lend you. Prepare these documents:

- Pay stubs: Bring in your most recent pay stubs (usually the last two or three). They’re like a sneak peek into your paycheck, showing lenders you have steady income.

- Tax returns: If you’re a freelancer or your income varies, lenders may ask for your last one or two tax returns. This helps them see the bigger picture of your financial landscape.

When you bring these documents, you’ll show lenders you can pay the money back!

Section 3: Employment Verification

Lenders want to feel confident that you will keep earning that income. This can involve:

- A letter from your employer: It’s a simple note confirming your job title, salary, and how long you’ve been working there. Think of it as a friendly recommendation, but for lending purposes!

- Contact information for your employer: Sometimes lenders want to follow up directly. Keeping it handy speeds up the process!

This step can help ease any worries a lender may have about your job security.

Section 4: Credit History

Your credit score is like your financial report card. It shows lenders how well you handle borrowed money.

- Credit report: You usually don’t need to provide this yourself, but knowing your score can help you understand what lenders might see. Think of it as a sneak peek at how you’re graded!

If your score needs some polishing, consider working on it before applying!

Section 5: Debt Information

Lenders want to understand your financial obligations. This could include:

- List of current debts: This can be student loans, credit card balances, or any other financial commitments. It’s like giving a snapshot of your monthly expenses.

- Monthly payment amounts: Knowing how much you need to pay each month can help lenders assess your ability to take on more debt.

This information helps them figure out if you can manage the loan without getting overwhelmed.

Section 6: Asset Verification

Lenders want to know what you own! This can help them gauge your financial stability.

- Bank statements: Bring the last few months of your bank account statements. They show how much cash is on hand—like showing your savings habit.

- Investment statements: If you have investments (like stocks or retirement accounts), be ready to share those too. They’re like your “financial backup funds.”

Having this documentation shows lenders that you have resources to draw from if needed.

Section 7: Loan-Specific Documentation

Finally, be prepared to provide any specific documents related to the loan you’re applying for:

- Purchase agreement: If it’s a home loan, you might need a copy of the purchase agreement. This is like the blueprint for your new financial commitment.

- Loan application: Fill out the lender’s application form—it’s usually straightforward!

Check in with your lender to ensure you have everything required for your specific loan type!

Conclusion & Call to Action

So, there you have it! The seven key documents needed for a loan—having these ready can simplify the process and reduce your financial anxiety.

Remember:

- Organization is key; gather these documents ahead of time.

- Staying informed about your finances is a great habit to develop early on.

Action Step

Take a moment now to make a checklist of these seven documents. Start gathering them one by one, and you’ll be one step closer to your financial goals!

You’ve got this, and I’m cheering for you every step of the way! 🎉